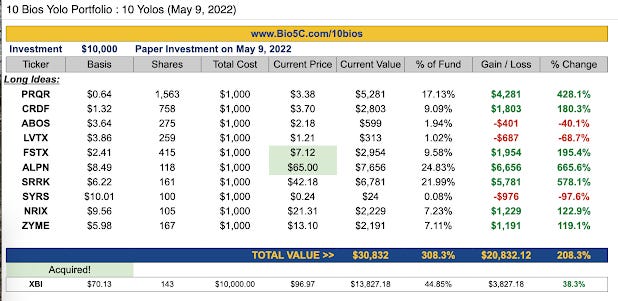

These articles are fun. It has been a while since I have written one. In fact, the last one I wrote was in May 2022, and I laugh when I go back and see the performance of those picks because I had one complete bust, two significant misses, and seven home runs.

It's the seven home runs that make me chuckle because I would not have predicted such success at the time. I called that portfolio my "10 Yolo Ideas", and it certainly panned out. So, let's cover some quick points before we get into my next 5 "Yolo" ideas for 2025.

First, biotech stock investing is difficult, and past performance does not guarantee future success. So be smart about your "Yolo" allocation. This leads to my second point, diversification. I have been preaching a barbell approach to biotech stock investing on Bio5C for the past two years. You will probably be familiar with this strategy if you subscribe to my service and listen to my podcasts and morning research notes on my Discord. I think 70% of your assets should be in high-quality, core positions. These are either late-stage clinical companies where I have a high conviction of success or commercial bios executing well. And the vast majority of my returns in 2024 have come from these key significant positions, which currently include TGTX (+134%), VRNA (+139%), KRYS (+76%), TARS (+102%), and AKRO (+27%).

With the other 30%, I suggest Yolo. But it's essential to define what I mean when I say Yolo. Yolo does not mean we have low conviction or are just throwing darts at our screen and crossing our fingers for success. Yolo means these names are higher risk, and we could quickly lose all our money in the idea with a strikeout. Owning to that risk, we should only allocate a small percentage of our portfolio to each of these ideas. However, these names have tremendous upside, so we don't have to put a lot of money into them either. In the article I wrote in May 2022, three ideas were up over 400%, and two were acquired. These profound successes - the Home Runs - are designed to make up for strikeouts. So, if you're going to Yolo, be smart about allocation, take a basket approach, and, for the love of God, let those winners ride!!

My final point is that - this article is free. So you are going to get what you pay for. If you want a complete analysis of these ideas, which includes a more detailed overview of the rationale for investment and a financial model showing valuation scenarios, please check out Bio5C.com.

Okay, on to my 5 "Yolo" ideas for 2025 (in no particular order):

KALA Bio (KALA)

KALA Bio, not KALA Pharmaceuticals, is developing KPI-012. Yes, it's the same company, but EYSUVIS and INVELTYS have been sold, and the entire focus of the company today is on the new secretome platform, with lead candidate KPI-012, a topical ophthalmic, non-preservative solution of secretome proteins produced by human mesenchymal stem cell (MCS-S). These proteins include growth factors (HGF), protease inhibitors (TIMP-1, TIMP-2, Serpin-E1), matrix proteins (Collagen), and neurotrophic factors (PEDF) that promote healthy and viability - qualified by ELISA - produced at commercial scale. KPI-012, which has Fast Track and Orphan Drug designation, is currently in a Phase 2b study called CHASE for the treatment of Persistent Corneal Epithelial Defect (PCED).

PCED is, for all intents and purposes, a wound on the cornea that fails to heal after two weeks of conventional therapy. Wounds to the eye are common and can be caused by trauma, infection, glaucoma, or excessive dry eye disease. However, these wounds typically self-limit or heal with conventional therapy, such as lubrication or topical antibiotics. In the rare events in which they do not heal, options become limited. In fact, there is only one U.S. FDA-approved treatment option for PCED, a product called OXERVATE, sold by the private Italian Pharmaceutical company Dompe. OXERVATE® (cenegermin) is recombinant human nerve growth factor (rhNGF), and as such, it is only for a particular kind of PCED called neurotrophic keratitis (NK). NK accounts for roughly one-third of the estimated 100,000 PCED cases per year in the U.S. Despite this small market, OXERVATE, which costs over $100,000 per course of treatment (4 cycles at ~$27k per cycle), generates approximately $1 billion in annual sales.

KALA's KPI-012, a mixture of secretome proteins, is in development for all types of PCED. If it works, KALA's product could be 3X as big as OXERVATE. The Phase 2b study will report initial data in Q2 2025. Target enrollment is 90 subjects at 35-40 academic and independent centers, mostly in the U.S., with some international centers. The primary endpoint is complete healing (percentage of subjects) at week 10, with follow-up to week 24.

There is a good chance that Phase 2b will succeed based on the prior Phase 1b data. Yes, this study occurred in Mexico, but eyeballs are eyeballs, and the results look solid. Looking at the primary endpoint, the Phase 1b data show that 6 of 8 patients (75%) achieved complete healing (note, the other 2 patients did improve, just not completely).

I estimate the control group will show 25% complete healing, and I based that off the two Phase 3 studies conducted by Dompe with OXERVATE that showed 17% and 33% for the control group. OXERVATE showed 65% and 72%. So KPI-012 at 75% seems legit, and to further increase confidence, the Phase 2b is testing 1 U/mL and 3 U/mL 4X daily, whereas the data from the Phase 1b I outlined above is only with 1 U/mL 2X daily. So, the two arms in CHASE are investigating 2X and 6X the dose that showed 75% in Phase 1b. I like these odds, especially with KALA trading less than $100M EV and KPI-012 addressing a $10 billion TAM.

Chmerix, Inc. (CMRX)

CMRX was entirely off my radar until the surprise regulatory announcement on December 9, 2024. The results of the dordaviprone Phase 2 study in relapsed/recurrent (H3) K27M–mutant diffuse midline glioma (DMG) were published in the Journal of Clinical Oncology in February 2024. This was an uncontrolled study, but those data suggest an ORR by RANO-HGG of 20% (95% CI: 10.0%, 33.7%) is marginally better than the 0-10% that would be expected from salvage chemo or radiation therapy, and the median OS of 13.7 months (8.0, 20.3) is nicely ahead of the 5.1 months reported from 12 subjects with H3 K27M–DMG who did not qualify for the Phase 2 trial. At the SNO conference in November 2024, CMRX presented an updated analysis showing 28% ORR (16%, 42%) using RANO 2.0 criteria, with PFS rates at 6 and 12 months of 32% (19%, 47%) and 27% (15%, 41%), respectively. If you're not jumping up and down at these data, you can now understand why the stock sold for less than $1/sh on December 8, 2024, and the enterprise value was negative $80 million.

All that changed on December 9, 2024. Prior to that regulatory update, investors were forced to wait for the results of the Phase 3 ACTION study, a controlled study investigating dordaviprone in the front-line (1L) setting, before the company was expected to seek approval. In Q3 2025, CMRX promised the first interim look at OS data from the Phase 3 study, with a relatively high bar for early stoppage (HR < 0.52). The likely outcome from that interim update is that the study will continue to the second interim update in 2026 and possibly to the final OS data in late 2026 or early 2027. So, like I said, off-the-radar.

However, on December 9, 2024, CMRX told us, "Following extensive dialogue with the U.S. FDA, the Company plans to submit a New Drug Application (NDA) seeking accelerated approval in the recurrent setting before year-end. This filing is based on the Phase 2 data published in J. Clinc Onc and recently presented at SNO'24. It's separate from the Phase 3 ACTION study in the 1L setting. The FDA opened the door, and now all CRMX has to do is walk through it. The regulatory cat is out of the bag and running loose. CMRX also told us they would seek priority review, which, if granted, would put the PDUFA in August 2025. They will also receive a Priority Review Voucher (PRV), which the last three have been sold for approximately $150 million (note CMRX would owe 50% of this value plus $30 million to Oncoceutics).

This was a big surprise to investors, myself included. Not only does this pull forward the first PDUFA for dordaviprone by approximately two years, but it also presents a significant catalyst and opportunity for valuation inflection with the shares. There are approximately 21,000 cases of glioma in the U.S. each year, and CMRX believes that 2,000 are the H3 K27M-mutant subtype. At an estimated price of $33,000 per month (comparable to Day One's recently approved OJEMDA®), dordaviprone targets a TAM of $800 million in the U.S. Outside the U.S., there are another 3,000 patients in the major markets (EU and Japan). With a reasonable market share, dordaviprone has peak sales of $400-500 million in the recurrent setting.

CMRX stock has already begun to re-rate, jumping over 200% since that regulatory update. But I don't think the run is over. In fact, I believe the stock will continue to move higher into FDA acceptance of the NDA in February 2025 and then the PDUFA in August 2025. Upon approval, modeling suggests the stock could be worth $10/sh, 3-4x where we are today.

Rezolute, Inc. (RZLT)

I like the name for several reasons. Firstly, it's flying under the radar of most investors. I base this on a quick search of SeekingAlpha, where there has been only one new article in the past year, and the number of posts on X seems limited to only a handful of biotech "X-perts". Before I delve into a new idea, I like to check these two places because I believe that if you want to be successful at finding "lotto" or "yolo" plays, you must avoid consensus of crowded ideas. The other two reasons I like the name are that they have a drug that works and the Phase 3 study to prove it will read out in late 2025.

RZLT is developing ersodetug, a fully human monoclonal antibody for the treatment of hypoglycemia. There are two development programs: congenital hyperinsulinism (CHI) and tumor-associated hyperinsulinism (TAHI). CHI is a rare pediatric genetic disorder characterized by excessive production of insulin by the pancreas. If left untreated, elevated insulin levels can cause extreme hypoglycemia (low blood sugar) events, increasing the risk of neurologic and developmental complications, including persistent feeding problems, learning disabilities, recurrent seizures, brain damage, or even death. TAHI is a rare disease caused by tumors that produce insulin or insulin-like substances such as IGF-2.

Both are orphan disease indications, and both have limited and ineffective treatment options. The standard of care for CHI is diazoxide, but the drug can result in some pretty serious side effects, including recessive hair growth, loss of appetite, swelling, gastrointestinal issues, facial changes, and pulmonary hypertension (black box warning). Additionally, only 50% of kids have sustained response to the drug. Glucagon or sugar can be used to raise blood sugar, but the effects are only short-term, and this is not a feasible option at night (while the child is asleep). In the most severe cases, pancreatectomy is an option, but that often results in long-term complications. For TAHI, removal of the (islet cell) tumor is the ideal option, but that's not always applicable, and if the cancer spreads to over organs, it's too late.

Regardless of the pathophysiology of hyperinsulinism, ersodetug works the same way. It binds to a unique site (allosteric) on insulin receptors throughout the body, such as in the liver, fat, and muscle. It modifies (down-regulates) insulin’s binding and signaling to maintain glucose levels in a normal range, which counteracts the effects of elevated insulin in the body. Ersodetug does not interfere with insulin binding to the insulin receptor – it appears to attenuate the impact, reducing the amount of glucose a cell absorbs.

RZLT is conducting a Phase 3 study in CHI called SUNRIZE. The study was initiated in May 2024, and top-line results are expected in late 2025. SUNRIZE is investigating two doses of ersodetug, 5 mg/kg and 10 mg/kg, compared to a placebo over a 6-month treatment period. All patients will be on standard of care. Enrollment is targeted at 48 participants over 1 year old, with an exploratory cohort of 8 infants over 3 months old. The primary endpoint is the change in average hypoglycemia events per week as measured by both on-demand and continuous glucose monitoring.

My confidence in the Phase 3 study stems from the stellar results from the Phase 2b RIZE study. RIZE was a small study with only 23 participants; still, data from the two relevant doses (6 mg/kg and 9 mg/kg) showed a 61% decline in hypoglycemia (< 70 mg/dL) and a 76% decline in severe hypoglycemia (< 50 mg/dL). Nearly all subjects achieved a > 50% hypoglycemia correction, with a 90% improvement at the top dose (with a nice dose-response). These results were presented at the ENDO meeting in May 2024.

RZLT is trading with a market cap of around $300 million ($200 million EV pro forma at year-end 2024). Ersodetug could be a $650 million drug in CHI. There are 1,500 addressable CHI pediatric patients in the U.S. and an equal number in Europe. The standard of care is limited, and this is a clear rare pediatric orphan disease pricing model, with patients expected to be on the drug for a very long time. The opportunity in TAHI could be another $300-500 million. If I'm correct, by the end of 2025, RZLT should have a clear path to filing a BLA on a potential blockbuster (> $1 billion) drug, and you can pick up that story right now for only $200 million in EV.

Larimar Therapeutics (LRMR)

This was a late entrant to the list. After seeing the 25% decline in the stock last week, I couldn't resist. A name rarely has as clear 10X potential as LRMR, so I love this setup for the next nomlabofusp update, which is expected in mid-2025.

Earlier in December, LRMR released an update from the open-label extension (OLEx) study from 14 patients taking 25 mg of nomla daily for up to 90 days. In a previous email blast, I wrote to Bio5C subscribers that I had a "negative bias" going into this update. That turned out to be the right call. So what made me flip from a LRMR bear to a LRMR bull on the news that sent the stock down 25%? Well, I figured the 25 mg dose would not be impressive on FXN levels or functional endpoints such as mFARS. Data from the previous Phase 2 suggest that LRMR needed a dose higher than 25 mg. As it turns out, the change in FXN level at 90 days, at least in the skin, was well above what I expected. Patients entered the OLEx study with an average FXN level of under 3 pg/ug. This equates to around 16% (9%, 25%) of normal. LRMR has been suggesting that if they can get patients to near 50%, they can show improvement on functional endpoints. I was skeptical that the 25 mg dose would show that type of improvement, but after 90 days, the median patient was just shy of 50% (43%, 161%). I've listened to a few KOL calls argue that you might not even need to get to 50%. So, this was a clear win from a PK standpoint.

LRMR continues to guide that they will file for accelerated approval (AA) in 2H 2025, noting during its call that they have general alignment with the U.S. FDA on FXN levels appearing to be the pathogenic mechanisms of Fridreigh's Ataxia (FA). And given that we have seen the FDA has been amenable to this type of filing, there is a precedent that if LRMR can show an increase in FXN levels, they can gain AA as long as the confirmatory Phase 3 trial is underway that will prove the thesis out with functional measures.

Regarding functional measures, they trended positive for the 25 mg dose. The key regulatory endpoint of mFARS showed a 1.17-point improvement (-3.8, 1.2) after 90 days. That matches up identically with the SKYCLARYS® data from the MOXIE study at 12 weeks, which showed a 1.2-point improvement for omaveloxolone compared to a 1.0-point improvement for the placebo. I think 90 days is probably too early to look at this endpoint because SKYCLARYS did not separate from the placebo until beyond 24 weeks, but I'm encouraged that the 25 mg nomla dose is in the same ballpark. I'm also encouraged that the other functional endpoints of ADL, Fatigue, and 9 Hole Peg Test also trended in the right direction.

But what I'm particularly excited about is the 50 mg data expected mid-2025 because the 25 mg OLEx data are remarkably consistent with the prior Phase 2 data, and that data clearly showed the 50 mg dose had a much more significant impact on (skin and buccal) FXN levels. Accordingly, my hunch is that when we see the 50 mg data, FXN levels will look much more impressive, and functional endpoints like mFARS will also show a more meaningful improvement. I'm hoping we have enough patient data for endpoints beyond 90 days, but it seems we will because the 50 mg dose started enrolling in May 2024, and the update isn't expected until mid-2025. Patients taking a higher dose for longer should mean better data.

Where this bet could fall apart is the safety of nomla. There were two serious adverse events reported in December 2024 for the 25 mg dose: one case of severe allergic reaction and one patient with a seizure. I will not cover the prior safety concerns with nomla; we all know about the dead monkeys. Safety concerns are what caused investors to sell LRMR off last week. But I'll make two quick points on this issue. Number one, if this indeed was a serious issue, then there is no way LRMR would have escalated all patients to the 50 mg dose. The DSMB is clearly watching this study closely. Severe allergic reactions are par for the course with biologics, and LRMR said the patient with the seizure has a family history of these events. So, while I'm not writing these off completely, they are not a significant concern. And number two, we are still 20X below the (lethal) preclinical levels and darn near what looks to be on target PK.

LRMR is trading at around $300 million market cap today, or only around $100 million in enterprise value based on a pro forma year-end cash balance of $190 million. Biogen acquired RETA and, with it, SKYCLARYS (omaveloxolone) for $7.3 billion. I'm not suggesting LRMR is worth $7.3 billion; second entrants never go for as much as the first. But this does seem like an incredible setup today with very important 50 mg data mid-2025, a potential BLA filing later in 2025, and a U.S. FDA PDUFA for nomla for FA in 2026, all for less than 5% of what RETA sold for in July 2023. If LRMR goes for 50% of RETA, there's your 10X.

Zentalis Pharma (ZNTL)

ZNTL provides the first opportunity for me to be right or wrong, with data from three studies expected in January 2025. This was a difficult name to diligence because, as of December 20, 2024, there are no corporate presentations or past events archived on the company's website. In a way, it's not surprising because the company just went through a major leadership change, announcing a new CEO, CMO, and Chairperson in November 2024, followed by a new CPO and CBO in December 2024. The November 2024 press release that announced the new CEO, CMO, and Chair noted that the company was planning to host an investor event in January 2025 where it would provide an update on azenosertib clinical data and provide guidance on the regulatory plans and registration-intent studies.

Investors largely ignored that news, although I found it encouraging for two reasons: They are hosting an event to provide an update, and at that update, we will hear about the next steps in development. With ZNTL stock trading at negative $185 million in enterprise value based on September 31, 2024 cash ($426 million), investors have written off azenosertib as a bust. And if that were true, a simple press release with, "We are deprioritizing, discontinuing, or putting up-for-sale azenosertib" would suffice rather than hosting an event. This leans positive, although I still think expectations for this January event are low.

Those low expectations might stem from the previous clinical hold the FDA placed on azenosertib in June 2024. The hold was due to two Grade 5 (fatal) adverse events (presumed sepsis) seen in the DENALI monotherapy study of azenosertib in platinum-resistant ovarian cancer (PROC). The hold was applied to the DENALI and the TETON (azenosertib for uterine serous carcinoma) studies. Not surprisingly, this news sent ZNTL's stock down from $11/sh at the start of June to $3.50/sh at the end of June. However, I am surprised that when the company announced the hold was lifted only three months later, in September 2024, the stock barely moved. And today, at $3.00/sh, we are even lower.

Azenosertib is an oral, small-molecule inhibitor of WEE1. WEE1 is a kinase that helps regulate the G1/2-M checkpoint by inhibiting cyclin-dependent kinases (CDK) to prevent premature mitotic entry. Inactive Cyclin/CDK complexes permit cell cycle arrest at checkpoints, allowing cells to repair DNA damage before mitosis. Inhibiting WEE1 can force cancer cells into uncontrolled mitosis, causing DNA damage and cell death. ZNTL is focusing on cancers that have high expression of Cyclin E1 (CCNE1 gene amplification) because these tumors are particularly dependent on WEE1 as a cell cycle checkpoint. ZNTL is exploring the drug as a monotherapy and in combination with (DNA-damaging) agents.

The last meaningful update from ZNTL came at ASCO in June 2024. In a Phase 1b monotherapy study that enrolled patients with uterine serous carcinoma (USC) and high-grade serous ovarian cancer (HGSOC), ZNTL reported a confirmed ORR of 37% (7/19) and median PFS of 6.5 months (2.8, 6.9). These are solid results. Refractory USC and HGSOC patients have a very poor prognosis. IC chemo in these patients is typically 10-15% and PFS is 3-4 months. In combination studies, ZNTL saw an ORR of 50% (11/22) and PFS of 7.4 months with paclitaxel, an ORR of 36% (10/28) and PFS of 10.4 months with carboplatin, and an ORR of 39% (5/13) and PFS of 8.3 months with gemcitabine. I expect an update on these data in January 2025.

I also expect an update on the Phase 2 DENALI study investigating azenosertib in Cyclin E1+ platinum-resistant ovarian cancer in January 2025. For reference, ELAHERE® (mirvetuximab soravtansine), a folate-receptor alpha-targeting ADC developed by ImmuoGen, delivered 42% ORR and 5.6 months of PFS compared to 16% ORR and 4.0 months of PFS for IC chemo in the Phase 3 MIRASOL study. AbbVie paid $10 billion to acquire IMGN shortly after these data. Finally, we should see initial data from the Phase 2 MAMMOTH study investigating azenosertib in combination with niraparib (GSK's ZEJULA®). These patients have already progressed on a PARP inhibitor, so I view the benchmark as similar to the salvage IC chemo noted above.

I like this play because expectations are low going into this event. The stock is trading at negative enterprise value; it trades lower today than the day they announced the FDA lifted the hold, and they should exit the year with over $380 million in cash (guidance is that this gets them into 2H 2026). I think peak sales in uterine and ovarian cancer are $600 million, and there are several earlier-stage programs in osteosarcoma, colorectal cancer, pancreatic cancer, and breast cancer I'm not assigning any value to at this time. With a strong update in January 2025, ZNTL should double and build momentum throughout 2025 as registration studies begin and partners come knocking.

Honorable Mentions

Any one of these names below could have made this list. Other ideas I had are:

TARA, CATX, GRCE, VYNE, INZY, MIST

Thanks for reading this article. I am long all 5 of these stocks, as well as TARA, CATX, MIST, and GRCE. Please check the Bio5C Model Portfolio on the Bio5C.com website for position size. If you enjoyed this post and are interested in more absolutely fantastic ideas like this, along with joining a great community of biopharma stock traders and investors, please consider subscribing to Bio5C.

Best of luck to everyone in 2025!

Cheers,

JNap

Please see complete disclosures and disclaimers on Bio5C.com

JAZZ to acquire CMRX at $8.55/sh!!!!!

CMRX: $2.99

LRMR: $3.92

ZNTL: $3.06

RZLT: $4.34

KALA: $5.84