Long Akero Therapeutics Into 96-Week SYMMETRY Data

I expect top-line results early January 2025 around the JPM/SF Healthcare Week

Bio5C is long Akero Therapeutics (AKRO) with a 4.3% position. We are also long a 1.5% position in 89Bio, Inc. (ETNB) for a proxy trade, putting the total bet on the FGF21 analog class at roughly 6%. This position could change at any time, but below, I outline the rationale for this bet.

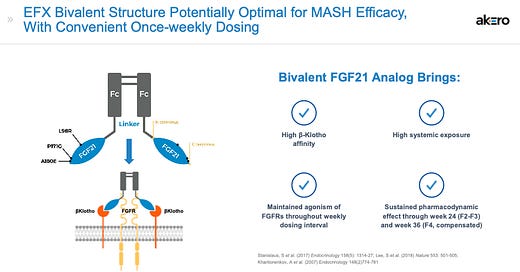

Akero’s efruxifermin (EFX) is an analog of the naturally occurring hormone fibroblast growth factor 21 (FGF21). It is a subcutaneous injection comprised of an engineered version of the human polypeptide sequence of FGF21 fused to the Fc domain of human immunoglobulin (IgG1). Has PRIME designation in the EU and U.S. FDA Breakthrough Therapy Designation and Fast Track status. Similarly, 89Bio’s pegozafermin is a novel glycoPEGylated analog of FGF21. These are alternative strategies to enhance PK.

FGF21 analogs are being investigated for the treatment of liver fibrosis based on their ability to modulate several pathways involved in the pathogenesis of liver disease. FGF21 is primarily produced by the liver, and it plays a significant role in regulating glucose and lipid metabolism. Liver fibrosis often occurs in the context of metabolic disorders such as metabolic-associated / non-alcoholic steatohepatitis (MASH/NASH), which is closely linked to insulin resistance, obesity, and dyslipidemia. FGF21 has been shown to exert anti-inflammatory effects by reducing the production of pro-inflammatory cytokines and macrophage infiltration in the liver. However, the most relevant mechanism for targeting liver fibrosis stems from FGF21’s direct anti-fibrotic effects by inhibiting the activation of hepatic stellate cells (HSCs), the primary cells responsible for producing extracellular matrix components like collagen.

Akero (and 89Bio) is interesting because, despite its ~3-year headstart, Madrigal’s Rezdiffra® is generally ineffective at improving the fibrosis stage in the F2/F3 population. The Rezdiffra® label shows improvement in liver fibrosis and no worsening of steatohepatitis of 23% and 24-28% for the 80 and 100 mg, respectively, compared to 13-15% for the placebo. The 11-13% placebo-adjusted improvement leaves the door wide open for far more effective therapeutics. The opportunity in the F4 population, where Rezdiffra® is not approved, is an even higher unmet need. That’s where I think Akero will shine.

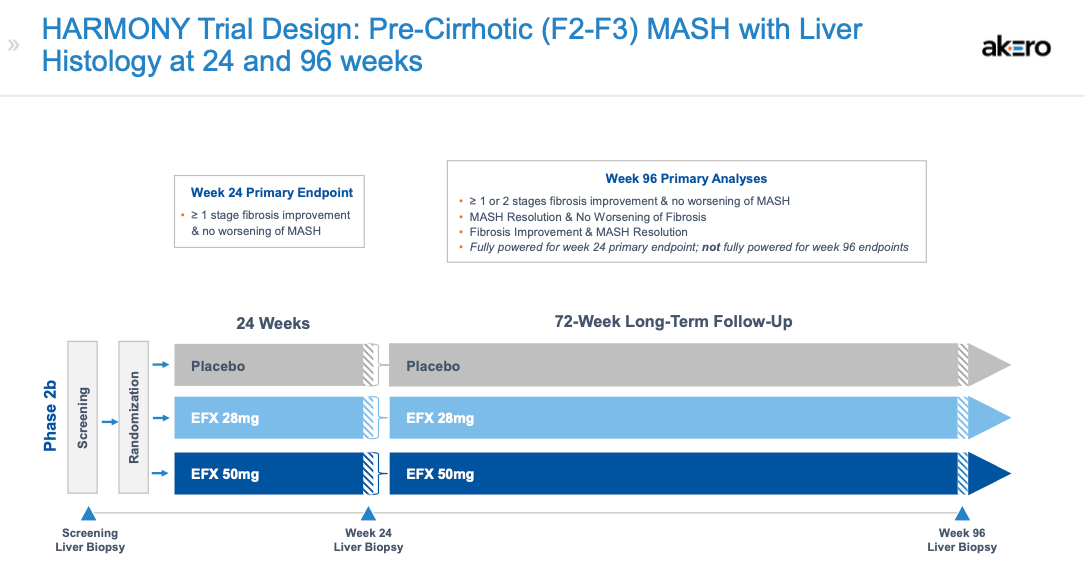

SYMMETRY is a randomized, placebo-controlled Phase 2b study investigating EFX 28 and 50 mg compared to placebo over 36 weeks. The primary endpoint is a ≥ 1 stage improvement in liver fibrosis and no worsening of MASH at week 36. Key secondary endpoints are MASH resolution, fibrosis markers, lipids, glycemic control, weight change, and other markers of liver injury.

The study was initiated in August 2021 and completed enrollment in December 2022 at 181 subjects. Here are the baselines:

We got top-line data in October 2023 from 153 biopsied subjects at week 36. The data were disappointing, showing only 22% and 24% improvement for EFX 28 mg and 50 mg, respectively, compared to 14% for the placebo. These results were not statistically significant. There were no clear trends based on background GLP-1RA use either, with patients in the 50 mg EFX showing no difference in fibrosis improvement and (placebo) patients only receiving GLP-1RA doing the worst.

The news sent Akero’s stock tumbling from $2.7 billion in market value the day before the news to a low of $650 million a few weeks after.

So right now, you’re probably saying to yourself, “JNap… what gives?” It seems this thing failed, but is the market cap back up to $1.8 billion! Why do you own this ahead of the 96-week update early next year?

Well, the answer is pretty simple. I think the 96-week data are going to hit. And here’s why: I think EFX was working; it just needs more time to separate from the placebo. I base that on the fact that all non-invasive fibrosis markers showed improvement, with ELF and Pro-C3 showing clinically meaningful reductions after 36 weeks.

The ELF (Enhanced Liver Fibrosis) score is a non-invasive blood test used to assess the extent of liver fibrosis (scarring) in individuals with liver disease. The ELF score is calculated using a combination of three biomarkers found in the blood: hyaluronic acid (HA), procollagen III N-terminal peptide (PIIINP), and tissue inhibitor of metalloproteinase 1 (TIMP1). These biomarkers are highly correlated to the process of fibrosis in the liver. Pro-C3 is a biomarker that reflects the formation of type III collagen, a vital component of the extracellular matrix that accumulates in the liver during the process of fibrosis. Similar to ELF, Pro-C3 is correlated with worsening liver fibrosis.

The kicker here is the time. Based on KOL calls I’ve been able to listen to, improvements in these markers should result in biopsy-proven improvements in fibrosis stage at 96 weeks. And that “improving improvement” is precisely what we saw in Akero’s Phase 2b HARMONY study, which was essentially the same design as SYMMETRY, except in the F2/F3 population.

In HARMONY, where approximately 2/3rds of the subjects were F3, 75% of the subjects on the 50 mg dose of EFX (w/ pair-biopsy) showed an improvement of ≥ 1 stage compared to 24% on the placebo after 96 weeks (p<0.001). And even when missing data was imputed as non-responders, the results (49% vs. 19%) were still stat sig at p<0.01. This was an improvement from the week 24 data that showed 41% for the EFX 50 mg dose compared to 20% for the placebo.

Okay, see if you can follow this chicken scratch below. What I’m showing here is that the delta between the 50 mg EFX dose and placebo at week 24 of 21% (41% - 20%) was stat sig (p<0.05) at N=113 patients. And that delta increased to 51% (75% - 24) at week 96 with N=88 patients (78% of the patients made it to week 96), which was also stat sig at p<0.001. Of the ≥ 1 stage improvement responding patients at week 24, 92% maintained response on EFX 50 mg compared to only 40% on placebo. And, 63% of non-responders at week 24 turned into responders at week 96 on EFX 50 mg compared to only 21% for placebo.

Here’s the non-invasive data from HARMONY. You can see that sustained improvements in ELF and Pro-C3 from week 24 through week 96 resulted in improved separation on the ≥ 1 stage improvement in fibrosis at week 96. Again, the separation went from 21% at week 24 to 51% by week 96 in HARMONY. That’s what I’m betting will happen in SYMMETRY.

From HARMONY, we know that the EFX groups in SYMMETRY are likely to continue improving. Based on HARMONY, we can also assume that the placebo group will unlikely continue improving (it may even regress). This is the basis of my thesis - EFX is going to go up, and the placebo is going to hold steady.

Based on HARMONY, 78% of the patients with biopsy at baseline completed the 96 weeks. That means of the N=50 patients at week 36, we can assume roughly 39 will be included in the week 96 analysis.

In SYMMETRY, there were 12 responders (24%) in the 50 mg EFX group at week 36. Based on HARMONY, we can assume ~92% of those patients who complete the full study will maintain a response. That’s 8 patients (12 x 78% x 92%, rounded down). Also, based on HARMONY, we can assume some portion of non-responding patients will achieve a response by week 96. In HARMONY, it was an astonishing 63%. But again, we are going to lose some patients. I don’t think it will be as high as HARMONY's 63% because HARMONY showed 41% responders during the initial 24 weeks vs. SYMMETRY at 24%, so what I’m plugging in here is the ratio of new to initial responders in HARMONY and then carrying that ratio over SYMMETRY. That equates to 37% new responding patients, which is 9 patients. I then add the 8 maintained responses to the 9 new responses and divide them by the 39 patients I expect to make it to 96 weeks, and I get a new response rate for the 50 mg EFX group at 96 weeks of 43%.

For the placebo, which showed a 14% response rate in SYMMETRY at 36 weeks, I think the number will stay roughly the same (in HARMONY, it went from 20% to 24%) or might actually come down. Why do I think it might come down? The 14% placebo number in SYMMETRY at week 36 was slightly higher than I expected. I thought it would be more like 8-10%. In 89Bio’s ENLIVEN, it was 0%; of course, this was only from N=1 patient. In Gilead’s Phase 2 ATLAS study, which enrolled 44% F3 and 56% F4 patients, at week 48, the placebo group showed 10.5% responders. The monotherapy firsocostat and citofexor arms were 12.1% and 11.8%, respectively. I also looked at the PROMETEO study of pirfenidone in advanced liver fibrosis patients, and at 12 months, only 4.5% of placebo patients saw an improvement in fibrosis stage.

One would think the placebo response rate in F4 patients would be lower than in F2 or F3 patients. But I’m not necessarily betting on the placebo arm in SYMMETRY to come down significantly. It just has to stay the same, which I think is a good bet.

Modeling a ~43% response rate for the 50 mg EFX at 96 weeks with ~39 patients and assuming the placebo group stays the same at 14% in around ~42 patients, we can now use online p-value calculators too see this delta of ~29% is highly statistically significant. In fact, it’s a greater delta than the 24-week HARMONY data in a very similar number of patients, which we know was stat sig at p<0.05.

Here’s a summary of my logic:

If I’m correct and Akero hits at 96 weeks in SYMMETRY, I think EFX is a blockbuster drug. There are approximately 1.5 million F4 patients in the U.S., and no drugs have been approved for this population. To date, no drug has worked in these patients in clinical trials.

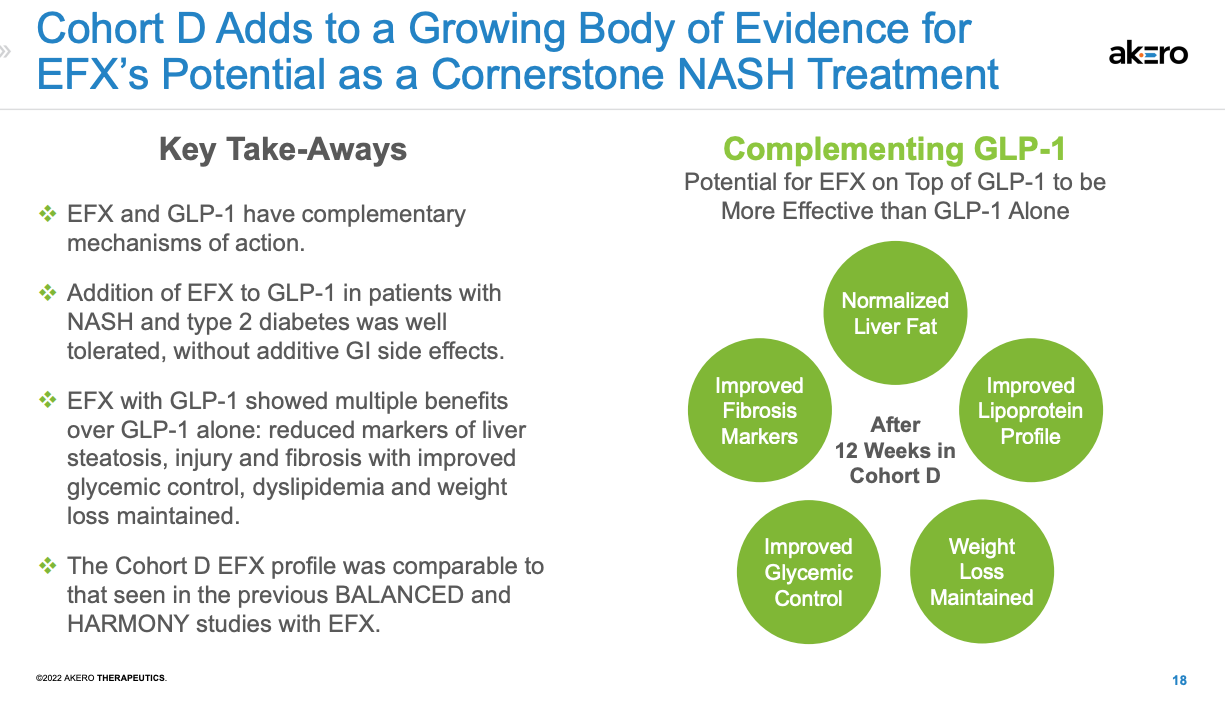

Data on fibrosis improvement in the F2/F3 population (from HARMONY) shows that Akero’s drug works twice as well in half the time as Madrigals (~21% at 24 weeks for EFX vs. 11-13% at week 48 for resmetirom). It works about the same, but in half the time as Lilly’s tirzepatide (~21% placebo-adjusted improvement at 1 year), and the Akero 96-week data from HARMONY is even better (~51% delta). There was also a 32-patient cohort (D) of SYMMETRY that investigated EFX on top of background GLP-1 (mostly semaglutide). These data show significantly greater reductions in liver fat by MRI-PDFF (-65% vs. -10%), greater improvements in ELF and Pro-C3, improvements in ALT and AST, improvements in HbA1c and insulin sensitivity, and numerically greater reductions in weight loss.

With positive data, I think the stock can return to $2.7 billion in market value. That would be $40 per share. Depending on the strength of the data, I think that $40 target could be conservative. If the SYMMETRY data at 96 weeks is a bust, showing no stat. sig improvement in fibrosis stage in the F4 population, Akero’s stock will be valued solely on the opportunity to take market share in the F2/F3 population, which admittedly will be a struggle against oral Rediffra® and emerging second- and third-generation GLP-1RA drugs, but not a zero in my view. Akero still has the best fibrosis data in F2/F3 patients from HARMONY. Sales here are less than the blockbuster ($1B+) level, but they are not insignificant at perhaps $500 million.

On June 30, 2024, Akero held $848 million in cash and investments. That’s plenty to complete the ongoing SYNCHRONY Phase 3 program and file for approval. However, If SYMMETRY fails, the downside in the stock is likely to be around $15 per share.

Cheers,

JNap

Please see all disclosures & disclaimers on Bio5C.com