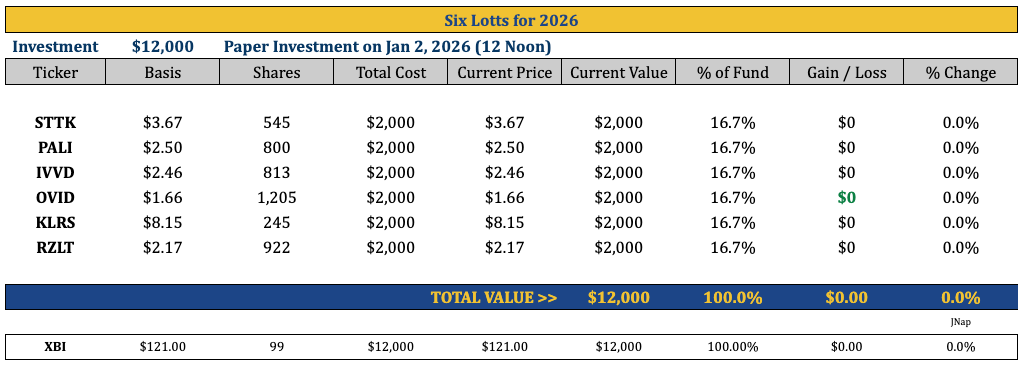

Six Lottos For 2026

STTK, PALI, IVVD, OVID, KLRS, RZLT

Hello Substackers!

It’s time for my annual tradition of listing several stocks that could either make you rich or lose you all your money! My six “lotto” picks for 2026!

Before we get going, let me remind you of the ground rules! First, investing in biotech stocks is difficult, so be smart about your “lotto” allocation! I’m more likely to go “Oh for 6” on these ideas than “6 for 6”. For example, at one point last year, my “Five for 2025” picks (CMRX, LRMR, RZLT, KALA, and ZNTL) were all winners, with RZLT, KALA, and CMRX each up well over 100%. In fact, at one point, the entire portfolio was up over 150%, driven by substantial gains in RZTL and KALA. Both failed pivotal clinical trials, and we ended the year flat - only CMRX (acquired) was a big winner. I recommend allocating no more than 12% of our portfolio to these lotto ideas. My second point is that some of these names will take more than 12 months to play out. I’m calling this “Six for 2026,” but I think you should consider the default holding period on these through year-end 2027. Point three: all ideas are exchange-listed, and nothing is under $1/sh.

My final point is that this article is free, so you will get what you pay for! I plan to produce more in-depth podcasts on some of these ideas in the coming months, which will be shared with Bio5C subscribers, LPs in Remsen Investors, and paid Substack subscribers. So, stay tuned!

Okay, on to my six ideas for 2026 (in no particular order):

Shattuck Labs (STTK) - $3.67/sh ($380M MCap)

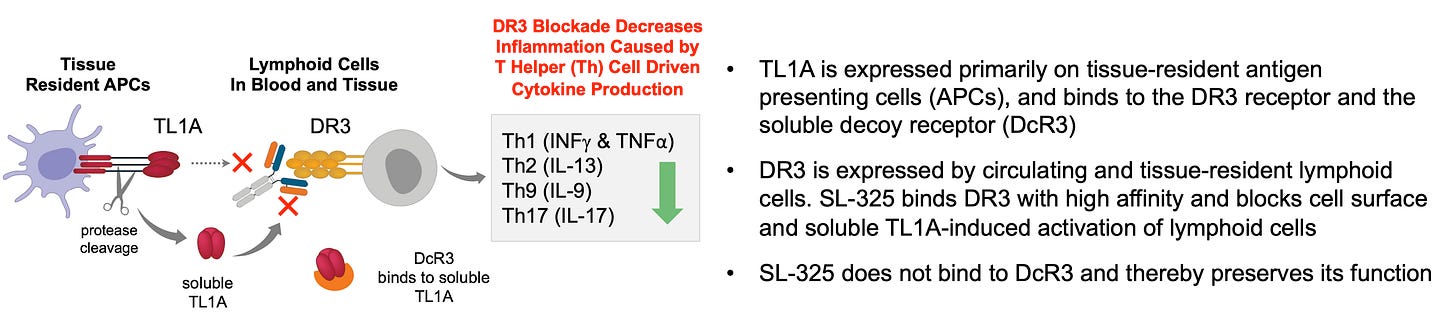

STTK is developing SL-325 for the treatment of inflammatory bowel disease (IBD), which includes both Ulcerative Colitis (UC) and Crohn’s disease (CD). The concept here is simple: blocking TL1A works. This is clinically validated by Merck’s tulisokibart (acquired via the Prometheus acquisition for $10.8 billion) and Roche/Pfizer’s RVT-3101 (Roche paid ROIV $7.1B for U.S./Japan rights, Pfizer has RoW rights). Sanofi and Teva are also in Phase 3 with duvakitug. TL1A is the ligand on APCs that binds to the receptor, DR3, on lymphocytes. TL1A signals only through the DR3 receptor, so it is highly plausible that targeting either will yield similar efficacy and specificity. However, TL1A also binds to a decoy receptor (DcR3) that naturally regulates (mops up) soluble TL1A. STTK believes targeting the receptor will result in better tolerability (lower or no formation of immune complex because it is membrane-bound) and higher potency because: 1) It leaves the (natural) decoy active, and 2) DR3 is stable on the lymphocytes (always there) and not “a moving target” like TL1A only on inflamed tissue. STTK also engineered SL-325 to have a silent Fc to prevent T cell killing through ADCC.

A Phase 1 study is ongoing, with data expected 1H 2026. Although this study is limited to HVs, it should provide valuable information on safety and tolerability (immunogenicity / formation of ADAs / risk of infections / risk malignancies / signs of DR3 agonism risk) and on receptor occupancy (potential efficacy read-through) for SL-325. There’s still significant risk here, but if these data look good, I expect STTK to shift focus to the YTE version, SL-425, for a Phase 2a in UC.

Cash is sufficient to move into Phase 2, but not enough to provide full comfort before a pivotal study, so they will likely need more in 2028. Guidance is that cash is sufficient to get into 2029. However, I’m assuming that includes the $57M from warrant exercises (~53M warrants at $1.08/sh), because the $75M currently on hand (pro forma exit 2025) appears to cover only the burn through late 2027. OrbiMed, Coastlands, Prosight, Adage, Redmile, and NextBio own those warrants.

The current market capitalization (diluted) is $380 million - not cheap per se, but less than the similar Palisade Bio (PALI), which I cover below. That said, the best comps for STTK are the $10.8 billion Merck-Prometheus and $7.1 billion for 75% ownership deal between Roche and Riovant. This frames a fair value for a post-Phase 2 proof-of-concept asset at $10-11 billion. This is more of a 2H 2027 / 1H 2028 event for STTK, but I think the safety and RO data from the Phase 1 HV study is a meaningful clearing event for the stock, and we will likely get these data in Q2 2026. This should bring STTK’s SL-325/425 to greater investor attention ahead of the Phase 2a study initiation. Then, we can start talking about relative comps for UC/CD drugs, including the aforementioned TL1A drugs at Merck, Roche/Pfizer, and Sanofi/Teva, Pfizer’s $6.7 billion acquisition of Arena (etrasimod), Lilly’s $3.2 billion acquisition of Morphic, and, of course, Abivax and its current $11.0 billion market cap (widely reported to be in active talks with Eli Lilly).

Palisade Bio (PALI) - $2.50/sh ($550M MCap)

PALI is developing PALI-2108, an oral PDE4 inhibitor for UC/CD. This one seemed easy to include, given the hype around Abivax and the recent positive UEG data from Hemay Pharma (China) with mufemilast, a similar selective PDE4 inhibitor. Celgene previously validated PDE4 inhibition for UC with apremilast (Otezla®) in a Phase 2 study. However, when Bristol acquired Celgene, it was required to sell Otezla® to Amgen due to potential competition with its TKY2 inhibitor. Amgen never moved forward with Otezla in IBD, likely due to the GI and low-grade CNS adverse events that came with the necessary higher exposure. I also think Amgen was looking for a cash cow with Otezla, and not highly motivated to conduct a large Phase 3 program that, if it had failed, could have negatively impacted the base business in psoriasis.

I think PALI’s approach could be best-in-class. Hemay’s mufemilast is a peripherally-restricted (minimal CNS penetration) PDE4B inhibitor. It’s designed to minimize the CNS side effects seen with apremilast, but the presentation at UEG in October 2025 did note dizziness and headache, as well as GI-related events, such as nausea. They did not specifically mention diarrhea, but I expect we might see GI issues with mufemilast as they conduct larger studies.

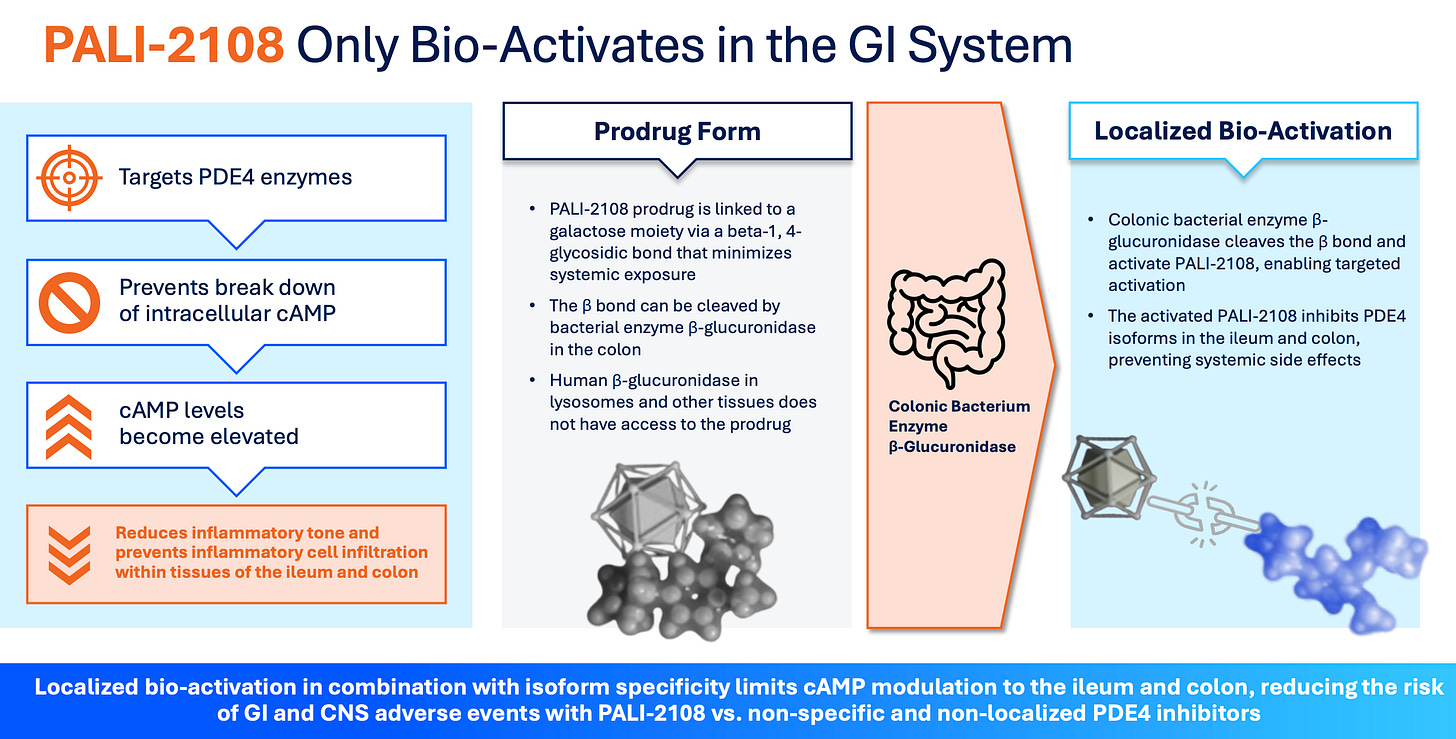

PALI’s drug is a colon-activated, specific PDE4 with a long half-life. They aim to mitigate systemic side effects by inactivating the drug, which only becomes active (releasing the active PDE4 inhibitor) upon cleavage by a bacterial enzyme (β-glucuronidase) in the colon. Initial Phase 1 data, which show low systemic activity and high fecal activity, look very encouraging. And it’s oral, so that’s where the Abivax comparison comes into play. Based on what we know to date, I’m confident PALI-2108 will work in UC. A Phase 2 study should begin around mid-2026. Before that, we will see data from a Phase 1b study in fibrostenotic Crohn’s Disease (FSCD) in Q1 2026. This will hopefully show anti-fibrotic biomarkers and downregulation of inflammatory cytokines. I ultimately think PALI might fail in FSCD, but as long as the Phase 1b data are directionally positive, it would help de-risk Phase 2a in UC, which would be the next major catalyst for the stock.

PALI raised $138M in October 2025, with Adage, ADAR1, Boxer, Coastlands, Deep Track, Janus, Octagon, Perceptive, RA Cap, and Squadron. The market cap today is around $550 million, more expensive than STTK, but PALI is around a year ahead in development. All the same comps apply, and I think STTK and PALI could each be worth $5-7 billion by the end of 2027.

Invivyd Inc (IVVD) - $2.46/sh ($750M MCap)

I have an entire 30 min podcast on IVVD, so be sure to check that out if you want to delve deeper into this idea, but the 10,000-foot summary on IVVD is that COVID-19 remains a significant health risk for many Americans, vaccine efficacy remains low at less than 50%, and uptake is even worse at only 25%. Previous efforts to develop (non-mRNA) alternatives, such as monoclonal antibodies from major players (e.g. Lilly and Regeneron, have failed due to variants. Only IVVD’s Pemgarda, which has U.S. FDA Emergency Use Authorization (EUA), is available for immunocompromised patients. However, commercial uptake has been hindered by its inconvenient administration method (a one-hour IV infusion plus two hours of observation) and a boxed warning for anaphylaxis. This has limited Pemgarda's sales to roughly $50 million.

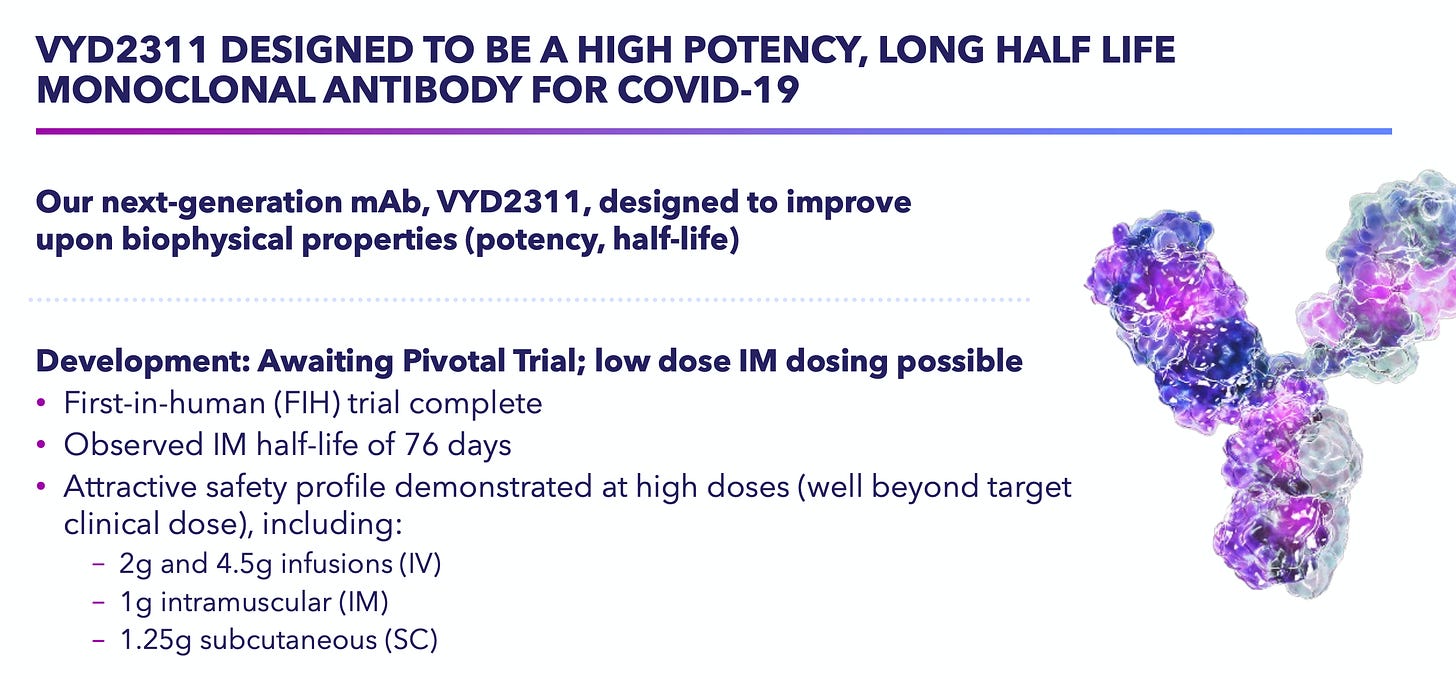

The core investment centers on Invivyd’s “third-generation” candidate, VYD-2311, engineered for increased potency and a longer half-life, enabling intramuscular (IM) injection rather than IV infusion and a six-month dosing schedule. The company has recently aligned with the FDA on two pivotal Phase 3 trials, Declaration and Liberty. Declaration is a Phase 3 study comparing IM VYD-2311 with placebo, and Liberty is a head-to-head study of VYD-2311 versus mRNA vaccines. These studies are currently enrolling, and data are expected in Q2 2026. I’m confident in (at least) non-inferiority given the substantial 94% reltative risk reduction in infection at three months demonstrated in the Pemgarda Phase 3 study.

I think IVVD represents an asymmetric opportunity given the company’s small market capitalization ($750 million) relative to the multi-billion-dollar revenue potential of the COVID booster market. We can draw a parallel between Cidara’s influenza program and Merck's recent $9.2 billion acquisition following positive Phase 2b data. Capturing just 10% of the market for the 60 million Americans currently receiving boosters could generate $3 billion in sales, making this Cidara 2.0.

Kalaris Therapeutics (KLRS) - $8.15/sh ($200M MCap)

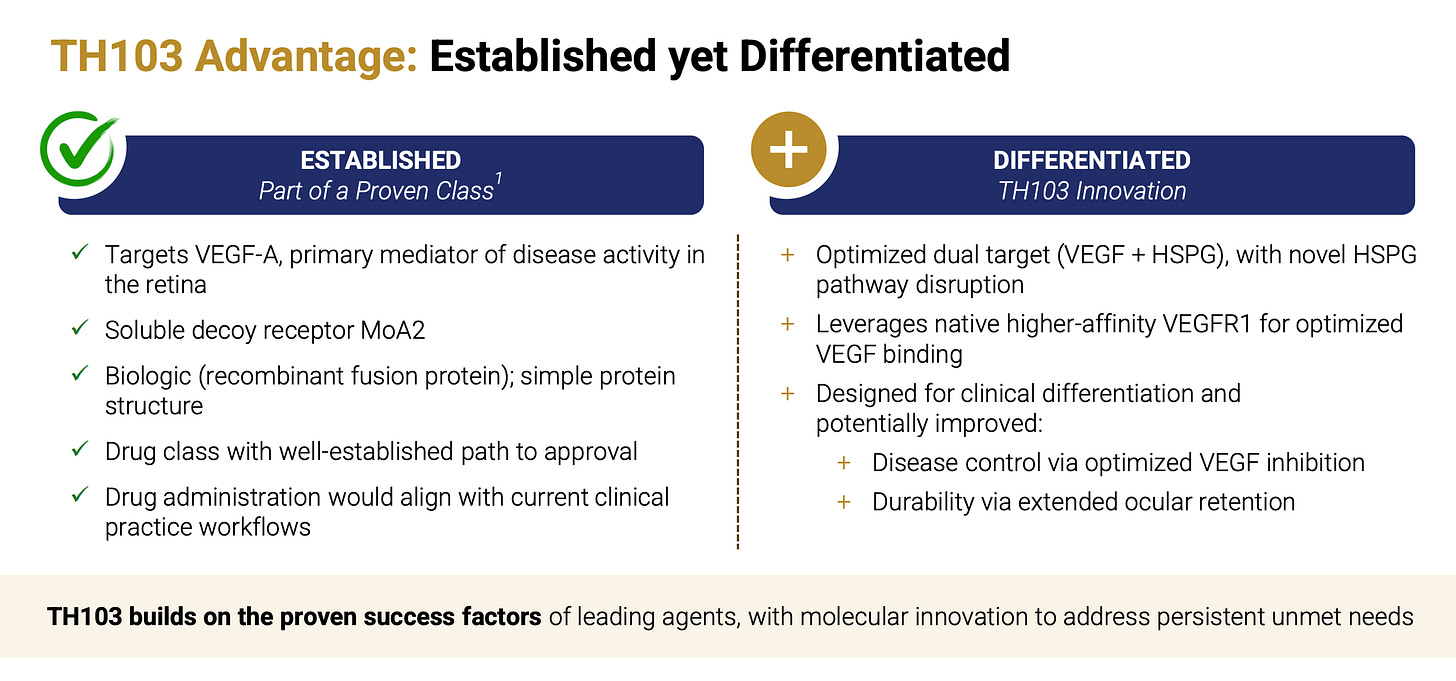

KLRS came to my radar two weeks ago after completing a $50 million private placement with ADAR1, Coastlands, Invus, RTW, Samsara, and Woodline. The company is developing TH103, an anti-VEGF fusion protein for the treatment of neovascular age-related macular degeneration (nAMD). When I first started looking at KLRS and TH103, I rolled my eyes (pun intended). Do we really need another anti-VEGF drug? But after a short while, I concluded that TH103 represents the next evolution of anti-VEGF therapy. Oh, and the company’s scientific co-founder, Dr. Napoleone Ferrara, is a Lasker Award-winning scientist known for isolating the genetic sequences of three human VEGF-A isoforms and for being one of the inventors of Avastin (bevacizumab) and Lucentis (ranibizumab), two of the leading anti-VEGF drugs in cancer and neovascular eye diseases.

TH103 is a next-generation VEGF “trap” built from VEGFR1 domains 2 and 3, designed to sequester VEGF-A more tightly by leveraging VEGFR1’s ~10× higher native binding affinity for VEGF-A versus VEGFR2. Unlike Eylea (aflibercept), which uses VEGFR2-D3, TH103 incorporates VEGFR1-D3 - a major heparan sulfate proteoglycan (HSPG) binding site - potentially anchoring the drug within vitreous/retinal matrices to extend intraocular residence and durability. If this translates clinically, the combination of tighter VEGF neutralization and increased local retention through HSPG could support longer dosing intervals compared with current anti-VEGF agents, including Roche’s Vabysmo (faricimab), which is on pace to generate approximately $5 billion in sales in only its third year on the market.

Vabysmo has captured nearly a third of the $15 billion global anti-VEGF market, thanks to flexible dosing that allows some patients to go up to four months (q16w) between doses, which is only slightly better than Eylea (q12w). If TH103 can extend to q20w or q24w, KLRS is sitting on a mega-blockbuster. The market cap is only $220 million. The $50 million private placement in Dec 2025 took place at $10/sh. The company is now funded well past the expected Phase 1b/2 read-out late 2026. We can all buy today at lower levels than ADAR1, Coastlands, RTW, etc.

OVID Therapeutics (OVID) - $1.65/sh ($212M MCap)

I debated whether to include OVID in this article because, while OV4071 clearly has “lotto-like” potential, the odds of success with OV329 seem decent as well, which limits downside risk. That’s certainly not a bad thing, but often when we think about these types of lotto plays, the outcome is zero or hero.

OV329 is the company’s next-generation GABA-aminotransferase (GABA-AT) inhibitor being developed as a treatment for rare and treatment-resistant forms of epilepsy and seizures. Ovid believes OV329 is significantly more potent than prior GABA-AT inhibitors, such as vigabatrin, which may provide comparable seizure-reduction efficacy with enhanced ocular safety at lower doses. Top-line results from a Phase 1 study in October 2025 confirmed biologic activity, albeit slightly below the efficacy benchmarks investors were hoping to see. More data from the higher-dose cohort are expected in Q1 2026. If that looks good, OVID should start a Phase 2 study mid-2026, and I think the market will begin to become more comfortable with OV329 as (at least) a $500 million opportunity for the company. This should put a floor valuation for the company at the current market cap of $210 million.

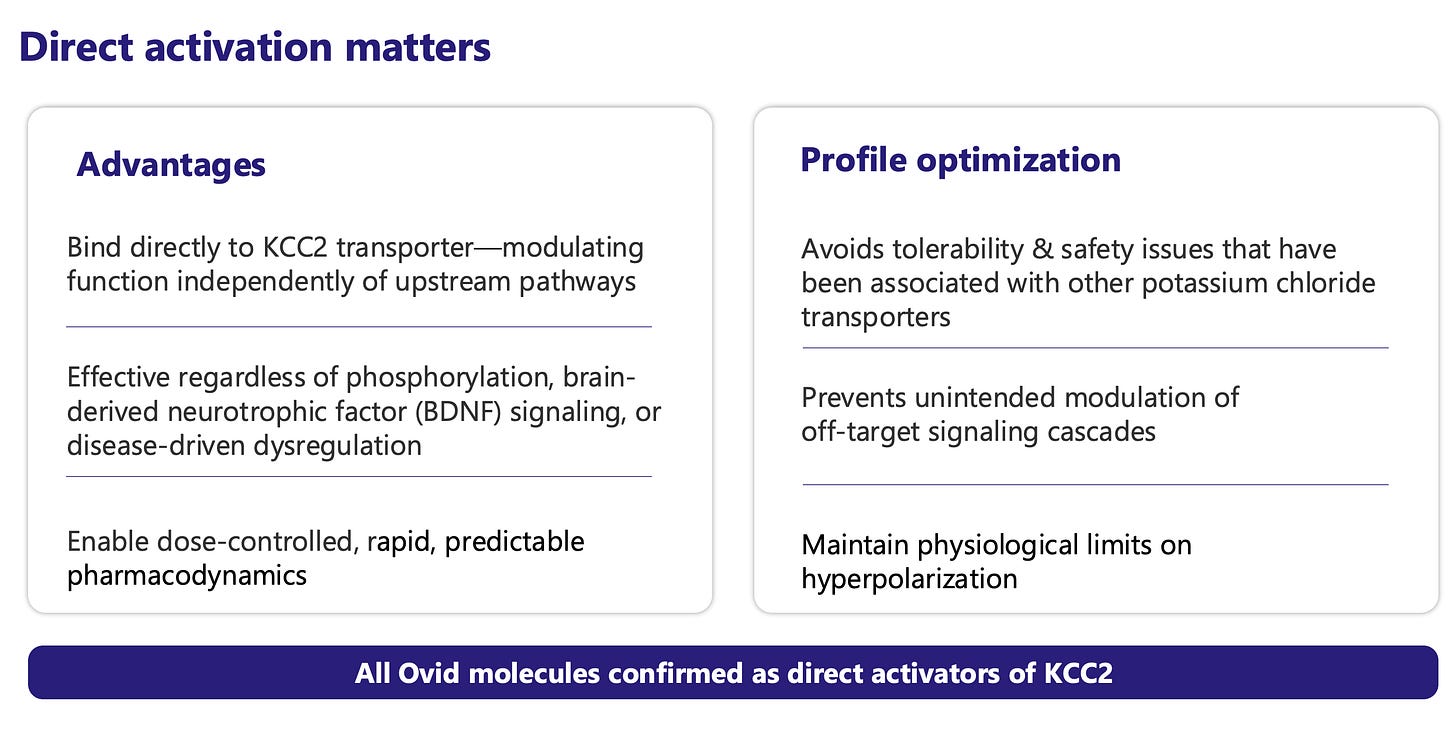

This downside protection makes investing in OVID for the KCC2 programs even more interesting. OVID is developing several KCC2 activators, including OV350 (IV) and OV4071 (oral). KCC2 is a neuron-specific chloride extruder - a “master switch” for neurological disorders that restores excitatory/inhibitor homeostasis. OVID thinks it is an ideal target because it (1) cannot be pushed beyond electrochemical equilibrium, (2) it has self-limiting activation, and (3) expression is confined to the CNS - all of which support potential long-term safety with chronic use.

In December 2025, OVID released preliminary data from the Phase 1 study with OV350 (IV formulation). Key findings indicate OV350 exposure levels within the pharmacologically active range, supporting central activity and spectral power consistent with KCC2 modulation. There were no treatment-emergent adverse events that met stopping criteria. Although OVID observed some associated headache and nausea, management believes these effects can be mitigated in future studies by adjusting the timing of food intake. A Phase 1 study with OV4071 (oral formulation) should begin in Q2 2026. Initial target indications are Parkinson’s disease (PD) psychosis and Lewy body dementia (LBD), but targeting KCC2 opens up potential in other diseases such as Rett syndrome, schizophrenia, epilepsy, spasticity, and Huntington’s. These are all multi-billion dollar TAMs.

Other companies have tried targeting KCC2 in the past, but off-target toxicity (lack of specificity and selectivity) resulted in sedation and motor impairment. Poor exposure (low BBB penetration) has also limited success. OVID believes it has developed the first truly specific KCC2 activator with no off-target or downstream effects on kinases regulating KCC2 activity (PKC, SPAK, WNK), excellent brain penetration, dose-dependent PD effects with linear/predictable PK, and oral QD dosing. If OVID has truly cracked the KCC2 nut, this is a 20X.

Rezolute Inc (RZLT) - $2.16/sh ($220M MCap)

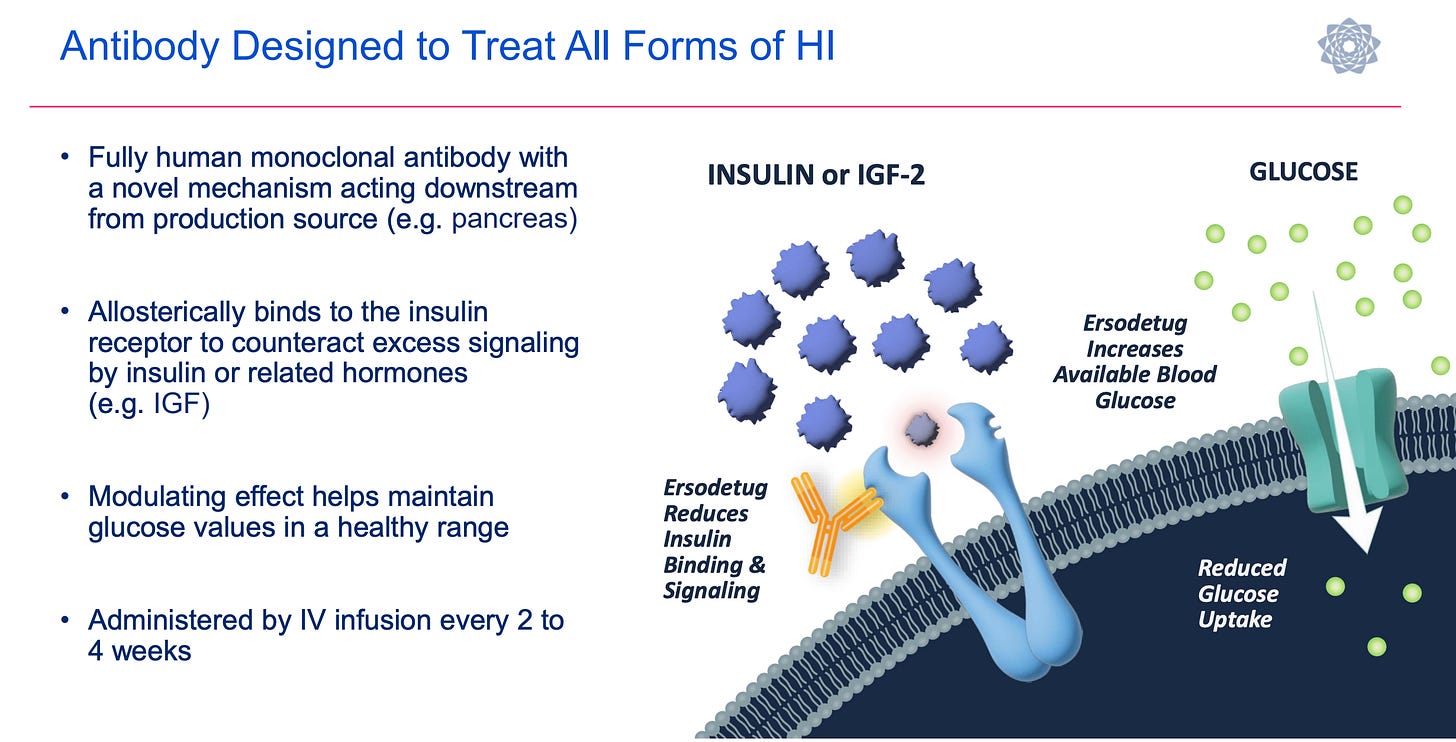

RZLT is my one holdover from last year’s list. At one point, I was up over 150% on the idea, but as I’m sure investors are well aware, RZLT’s Phase 3 SUNRIZE study in congenital hyperinsulinism (CHI) failed in December 2025. For the primary endpoint of average weekly hypoglycemia events (based on self-monitored blood glucose), ersodetug achieved a 45% reduction, compared with 40% for the placebo. This was the worst-case scenario for the study, as ersodetug substantially underperformed from the 74% reduction (pooled, 6 and 9 mpk) reported in the Phase 2 RIZE study, and the placebo outperformed the ~30% estimate the company used for its statistical power assumptions. The interesting thing about the data is that there was a secondary endpoint of average daily percent time in hypoglycemia (by continuous glucose monitoring). While that also failed to show statistical significance, the efficacy signal was a lot stronger, with patients on the 10 mpk ersodetug showing a 25% reduction in total time compared to a 5% increase in total time for the placebo.

The bear case is that placebo response and endpoint noise weren’t the whole story, and the actual effect size may be smaller than Phase 2 suggested. However, I don’t think that is the case. I don’t believe the Phase 3 SUNRIZE study failed because the drug doesn’t work. I believe it failed due to the trial design, which required children to periodically self-monitor, which alone has inherent variability, all while under continuous monitoring, which introduces significant bias and observational effects. I also find it interesting that RZLT management has stated all subjects elected to move into the extension study, and they are anecdotally seeing children with long-standing CHI manage their condition with only ersodetug.

Here’s my best analogy to what happened: A police department is asked to monitor for speeding on a 10-mile stretch of highway. However, at the start of the 10-mile stretch, there’s a sign that says, “We’ve placed cops at mile markers 2, 4, 6, and 8, so please call out your speed as you pass by so we can write you a ticket!” The result: every driver is now staring at their speedometer, leading to fewer tickets issued.

I think ersodetug works for CHI, and at some point, RZLT will have to run a new trial. In the meantime, we will get data from a separate indication, tumor-associated hyperinsulinism (THI), in the 2H 2026. The concept here is the same, only instead of children with a congenital disease, these are adults with a tumor (mostly insulinomas) that is directly causing too much insulin production. To counteract elevated insulin levels, patients receive a continuous parenteral glucose/dextrose infusion. RZLT is conducting a single-arm, open-label, Phase 3 study, upLIFT, in 16 adults with uncontrolled hypoglycemia due to tumor(s) on background SoC (IV glucose). The primary endpoint is the number of participants achieving ≥ 50% reduction from baseline in IV glucose (glucose infusion rate - GIR). In a five-patient compassionate use study/EAP conducted by NANETS, all five patients met this endpoint: four (80%) were able to completely discontinue IV dextrose, and the fifth achieved a 50% reduction.

At this point, it remains unclear how RZLT will proceed with ersodetug and what the next steps are in both CHI and THI. But as I said, I think ersodetug works - it’s just finding the right trial design and then generating the data. They have cash. The FDA has been amenable to working with RZLT in the past, agreeing to an amendment to the upLIFT study in August 2025 that positioned it for a high likelihood of success in 2H 2026. RZLT’s stock dropped 90% after the failure of SUNRIZE, but has since recovered with 100% gains off the low. I like buying stuff on sale. The CEO, CFO, and CMO all added, as did RA Capital and Opaleye, who took 9% and 5% positions, respectively.

Conclusion

Lotto-bio investing is risky. There’s a thin line between any of the above names returning 10-20X and being total zeros. If STTK’s SL-325/425 is no better than tulisokibart or duvakitug, it’s a zero. If PALI’s PALI-2108 cannot mitigate CNS or GI-related toxicity, it’s a zero. If IVVD cannot deliver VYD-2311 via IM dosing with (at least) mRNA efficacy and durability out 6 months, it’s a zero. If KLRS’s TH103 is no better than Vabysmo, it’s a zero. If RZLT fails in the Phase 3 THI study, it’s a zero. OVID is a little different animal because it has two legitimate shots on goal. Still, if the company cannot deliver on the promise of KCC2 activation, it becomes far less interesting as a lotto play.

So, keep these positions small - I suggest 2% in each, and be patient because some of these ideas are going to require a holding period beyond 12 months.

Good luck to all!!

Cheers,

JNap

Disclosure: I’m long the entire basket

Love $KLRS & $RZLT, have you looked at $LPCN?