This is a bit of a hindsight post, considering I sold the stock on Monday, July 22nd, ahead of the top-line release of the updated P2b CLOVER-WaM data on Tuesday, July 23rd, and the webcast on Wednesday, July 24th. Today is Friday, July 26th. So, I’m not doing you any favors by posting ex post facto. Then again, this Substack is free, so if you want real-time analysis on news like this, including real-time insights into my trades, please consider joining Bio5C and my Discord.

I woke up Monday morning to see that Cellecar Biosciences (CLRB) raised $19.4M via the exercise of Tranche B warrants. The company was running low on cash, estimated at $28M pro forma on June 30, 2024. Burn is around $12M per quarter, so cash was down to less than 9 months. I have no issues with the company raising cash. Let me be clear: This is not a rant against micro-cap biopharma companies raising cash. That’s what they do. If you’re upset when your smid-cap biopharma company raises cash, you should invest in a different industry.

But the deal Monday was not something I expected, and disappointing on several fronts for everyone else who did not get to participate in the offering. Let’s get into the terms of the deal.

The Tranche-B warrants were originally issued as part of a structured financing in September 2023. That private placement resulted in issuing ~13.5M shares at $1.82/sh, which grossed Cellectar $24.5M in cash. Included in that structured deal were ~13.8M Tranch-A warrants that were exercisable at $3.185/sh and expired 10 days following the announcement of the top-line data from the CLOVER-WaM study, and those above ~7.2M Tranch-B warrants that were exercisable at $4.775/sh and expired 10 days following the receipt U.S. FDA approval for iopofosine-131 (estimated to take place around the middle of 2025). The financing was led by Rosalind Advisors with participation from AIGH Capital, ADAR1, Second Line, Nantahala Capital, AuGC, and other new and existing institutional investors.

The Tranche-A warrants were fully exercised in January 2024. Nevertheless, with the stock at $2.52/sh on Friday, July 19th, and only enough cash to get into Q1 2025, it was clear that Cellectar could not wait for the final approval of Iopo-131 to raise cash. Those Tranche-B warrants were not worthless, but the strike price was 90% above the recent close, and the key trigger was six months beyond the burn. So they had to do something.

What Cellectar did was lower the exercise price of the Tranche-B warrants, which Black-Scholes modeling (at 100% IV, $2.52/sh spot, $4.78/sh strike, +12 months) suggested were worth around $0.55/sh, to $2.52/sh. So immediately, holders of the Tranche-B warrants saw a ~365% increase in value. That alone seemed like enough motivation for the deal. However, what rubbed me the wrong way was all the follow-on inducements. Inducement warrants included:

6.7M New A-warrants immediately exercisable at $2.52/sh, which expire 10 days after the FDA acceptance of the Iopo-131 NDA (estimated in February 2025). Black-Scholes modeling on these warrants (100% IV) shows a fair value of around $0.75/sh. These are new warrants not included in the September 2023 financing, and the strike place of $2.52/sh baked-in no upside for accomplishing the milestone. I think that was disappointing to see.

8.2M New B-Warrants immediately exercisable at $4.00/sh, which expire 10 days after FDA approval of Iopo-131. Black-Scholes shows fair value for these around $0.65/sh. Under the September 2023 financing, these were priced at $4.775/sh per share. I estimate this will take place around the middle of 2025. To raise the same $33/34M on this monumental milestone, Cellectar agreed to issue an additional 1M shares at $0.775/sh lower price. I think that was disappointing to see.

4.3M New C-warrants immediately exercisable at $5.50/sh, which expire 10 days after the company reports quarterly revenue for Iopp-131 exceeding $10M. I estimate this will take place late 2025. Black-Scholes calculates the value of these warrants at $0.70/sh.

Here’s my math on the deal, which shows a “net” price to participants of around $0.22/sh to do the deal.

So, was this a good deal for participants? Hell yeah it was! They got a 365% markup on Tranche-B warrant they’ve been holding for ~9 months and got three more tranches of warrants - for free - that Black-Scholes says are worth $2.10/sh total in value.

For the rest of us…

Current shares outstanding is around 54M. Future dilution from the new inducement warrants is around 19M, or 35%. Cash (pro forma) exit July 2024 should be around $42M, enough to get the company into Q2 2025.

When I saw the deal on Monday and did the above math, I sold my entire position. Not only was I disappointed with the financing terms, but the timing was suspect as well, given that the company had previously publicly announced a webcast to present updated CLOVER-WaM data on July 24th. Amazing data probably would have sent the stock well above $3.00/sh, which would have allowed for better terms on the Tranche-B warrant reset and likely better terms on the inducement warrants. I guessed that the data must not have been that strong, or else all the inducements to participate would not have been necessary.

I Guess Correctly

On July 24, 2024, Cellectar held the webcast and presented updated data from the P2b CLOVER-WaM study. I was thoroughly disappointed with the update. Here’s a nice summary from Madeleine Armstrong at ApexOnco: Cellectar Clarity Fails to Win Over Investors. (Data summary from her article):

Since the January 2024 update, Cellectar has promised us “better data” with a longer duration. They did not deliver. While ORR went up slightly, the more critical MRR ticked down. The 56% is still well above the hurdle set for success at a measly 20% but came in below next-gen BTKi, such as pirtobrutinib. We also saw the 8% CRR on 41 patients in January 2024 drop to 7% CRR+VGPR on 55 patients in July. So it looks like we got no new CRs with the extra 14 patients, and one of the four (7% x 55 patients) was a VGPR (decline >80%, but not 100%). Hmm…

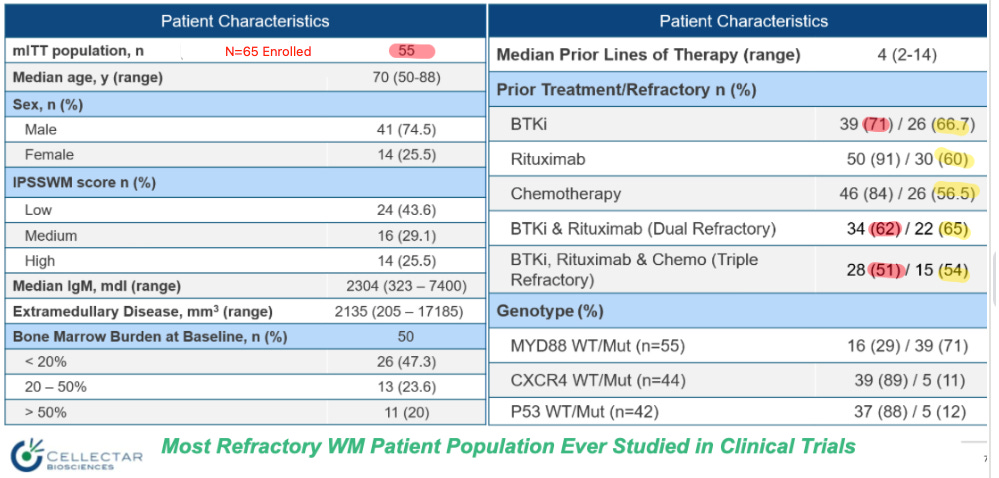

I’m also rather confused by the baseline for this study. Cellectar told us this is the, Most Refractory WM Patient Population Ever Studied.” But take a look at the baselines for the patients enrolled:

Are these patients truly “the most refractory” ever studied? Only 71% of mITT patients had a prior BTKi, and only 67% were refractory to BTKi. Only 62% of the patients had dual BTKi + rituximab, and only 65% were refractory. Only half the population had all three options, BTKi, anti-CD20, and chemo, and only half were triple-class refractory. Dual-class refractory patients comprised only one-third of the total 65 enrolled, and triple-class refractory comprised less than one-quarter. This population was not on their last hope. Thus, I expected better.

And speaking of the 65 enrolled, how come we only got data on 55? On the webcast, management said these 55 received ≥60 millicuries total administered dose of Iopo-131. Management did not go into more details on the webcast about why 10 patients failed to get above 60 millicuries. Maybe some died? Maybe some could not tolerate the drug? Maybe some progressed after a cycle or two and never came back. I’d like to know, wouldn’t you?

When I heard all this on Wednesday, I was glad I sold on Monday.

What’s Next for Cellectar?

Management plans to file the NDA in Q4 2024. If that takes place in December 2024 (I’m assuming the worst), FDA acceptance will take place in February 2025, and that should hopefully put the stock back above $2.52/sh, which will allow the holders of the Inducement-A warrants to exercise and throw the company another $17M. That’s still barely enough to get them comfortably past PDUFA. And I think acceptance is far from a sure thing. CLOVER-WaM was a single-arm, Phase 2b study that enrolled 65 patients, with data on only 55. Is that sufficient for U.S. FDA approval? Will the FDA want to see a larger study in more refractory patients? Or will they want to see Iopo-131 go up against some control? It is very possible.

Right now, we only see the response data. It is likely at ASH’24 we see PFS and OS data. Maybe those data will blow me away, and I’ll change my tune. I estimate there are roughly 6000 ≥2L and 1000 ≥3L refractory WM patients in the USA. Based on the top-line data from CLOVER-WaM and the baselines of that study, I think the ≥3L is where Iopo-131 will play, but at $150-200k per cycle, with 4 cycles, the TAM is easily $800M. Can they take half of that? If so, that’s $400M, and modeling suggests the stock could be worth 2-3X that with an NDA under review. So I’ll keep watch here, but for now, I’m on the sideline.

Cheers,

JNap

Please see my disclosures on Bio5C.com

Pretty good exit call. Down to $1.60/sh today.

And... they are giving up. WOW

This could go bankrupt.